Registered Auditors in Dubai Gold and Diamond Park UAE – MAK

Dubai Gold and Diamond Park Auditors 🥇 Dubai Gold and Diamond Park is a well-known commercial destination in Dubai. It has served customers and investors since 1995. The park is located in the Al Quoz industrial area, which is a strategic location in the city. This destination is famous for gold, diamonds, and fine jewelry. […]

Accounting For The Pharmaceutical Manufacturing Industry – MAK

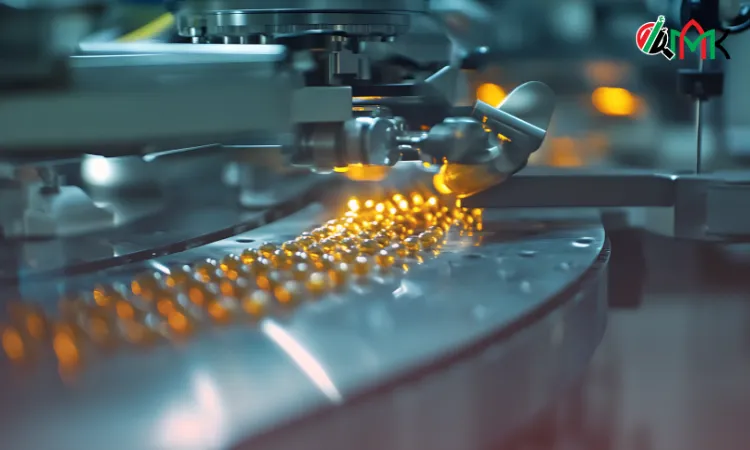

Pharmaceutical Manufacturing Industry Accounting in UAE 🥇 The pharmaceutical manufacturing industry in the United Arab Emirates is growing at a steady pace. The country offers a stable political environment and supportive government policies. These factors attract global investors and international manufacturers to the region. The UAE aims to become a regional pharmaceutical manufacturing hub. This […]

Choose the Best Auditors in Dubai Healthcare City Free Zone – MAK

Dubai Healthcare City Free Zone Auditors 🥇 Dubai Healthcare City Free Zone is a dedicated healthcare and wellness zone located in Dubai, United Arab Emirates. It was developed to support medical, clinical, and wellness services in a regulated environment. This free zone offers modern infrastructure and strong regulatory oversight, which helps healthcare businesses grow in […]

Accounting Services For Bread Manufacturing Units in Dubai – MAK

Accounting Services for Bread Manufacturing Units in Dubai – Overview Accounting services for bread manufacturing units in Dubai play a vital role in business stability and growth. The manufacturing sector remains a strong pillar of economic development in the UAE. Bread manufacturing units operate in a fast-moving and cost-sensitive environment. These units must manage raw […]

Approved Auditors Dubai Knowledge Village Free Zone UAE

Dubai Knowledge Village Free Zone 🥇 Dubai Knowledge Village Free Zone – Overview Dubai Knowledge Village Free Zone is a well-known education and knowledge-based free zone in Dubai, United Arab Emirates. The free zone was established in 2003 to support learning, innovation, and professional development. It was created to build a strong environment where education, […]

Mergers and Acquisitions Services in Abu Dhabi – MAK

Mergers and Acquisitions Services in Abu Dhabi 🥇 Mergers and acquisitions services in Abu Dhabi help businesses grow through planned financial transactions. These transactions include mergers, acquisitions, buyouts, and asset transfers. Companies use these strategies to expand markets, improve operations, and increase value. Every transaction requires careful planning, expert review, and strict compliance. Mergers and […]

Registered Auditors in Dubai Logistics City Free Zone UAE – MAK

Dubai Logistics City Free Zone Auditing Guide 🥇 Dubai Logistics City Free Zone is a specialized business hub located in the United Arab Emirates. It is designed to support logistics, supply chain, and value-added service businesses. The free zone operates as a core part of Dubai South, earlier known as Dubai World Central, which was […]

Dubai Knowledge Park Free Zone Approved Auditors in the UAE

Dubai Knowledge Park Free Zone Auditors Guide 🥇 Dubai Knowledge Park is a well-known free zone in the United Arab Emirates. It supports businesses that focus on education, technology, training, and professional services. The free zone offers a strong base for companies that want to grow in a modern and knowledge-driven economy. Dubai Knowledge Park […]

Accounting Services For The Manufacturing Sector In the UAE – MAK

Manufacturing Sector in the United Arab Emirates 🥇 United Arab Emirates has built a strong and diverse economy over the years. The manufacturing sector plays a major role in this growth. It stands as the second-largest contributor to economic development after trade and services. Many industries operate under this sector, including food processing, metals, chemicals, […]

Accounting For Tobacco And Cigarette Manufacturing Industry – MAK

Overview of the Tobacco and Cigarette Manufacturing Industry The tobacco and cigarette manufacturing industry includes companies that produce cigarettes, cigars, chewing tobacco, snuff, and pipe tobacco. These products are manufactured through highly automated systems that operate under strict regulatory controls. In Dubai and the wider UAE, this industry functions under close supervision due to health, […]