VAT Training in UAE for Businesses – MAK Approved Auditor

VAT Training in UAE The United Arab Emirates has a fast-moving business environment. Companies must follow tax rules to stay compliant. Value Added Tax became effective in the UAE in 2018. Since then, VAT has changed how businesses manage accounts and reports. VAT training in UAE helps businesses understand these changes. It supports compliance and […]

Real Estate Audit Services in Dubai 🥇

Real Estate Audit Services in Dubai Dubai is known for modern buildings and planned communities. People from many countries invest in property here. The real estate market needs strong rules to stay stable. Proper audits help protect investors and owners. A real estate audit checks records, systems, and compliance. A real estate audit ensures transparency […]

Tax Residency Certificate in UAE Guide 🥇

Tax Residency Certificate (TRC) in UAE A Tax Residency Certificate (TRC) in the UAE is an official document. The Federal Tax Authority issues this certificate. It confirms that a person or a business is a tax resident of the UAE. This certificate helps individuals and companies prove their tax status. The TRC supports the use […]

VAT Return Filing Services in Dubai UAE 🥇

VAT Return Filing Services in Dubai, UAE VAT Return Filing Services in Dubai help businesses stay compliant with UAE tax laws. Every registered business must submit VAT returns on time. The filing process reports VAT collected and VAT paid during a tax period. This process supports transparency and legal compliance. VAT return filing is a […]

Audit in UAE Free Zones – MAK Auditing 🥇

Audit in UAE Free Zones Audit in UAE free zones plays a vital role in ensuring business transparency and regulatory compliance. The United Arab Emirates has established multiple free zones to support local and international businesses. These zones offer attractive benefits, such as tax incentives, full ownership, and simplified regulations. However, free zone companies must […]

Due Diligence Audit UAE – MAK Auditing 🥇

Due Diligence Audit in the United Arab Emirates A due diligence audit is a structured review process that evaluates a company’s financial position, business performance, and operational strength. This audit helps buyers, investors, and stakeholders understand the real condition of a business before making important decisions. The process highlights risks, opportunities, and hidden issues that […]

Fraud Investigation Audit UAE – MAK Auditing 🥇

Investigation Audit Services in the UAE An investigation audit is a detailed review process that helps businesses identify fraud and irregular activities. This audit helps uncover the real cause of fraud and the exact level of damage caused. Companies use this audit to understand both financial and non-financial losses. A proper investigation audit supports decision-making […]

Tax Auditors in UAE – MAK Auditing 🥇

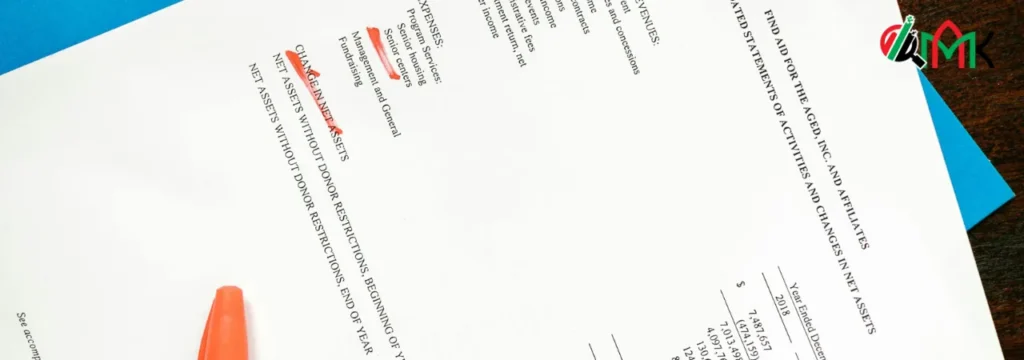

Tax Auditors in the United Arab Emirates Tax auditors in the United Arab Emirates play an important role in maintaining transparency and trust within the tax system. A tax audit is a formal review process carried out by the Federal Tax Authority. The purpose of this review is to examine business records, financial data, and […]

AML Compliance Services UAE by MAK Auditing 🥇

Compliance and Anti-Money Laundering in the UAE Anti-Money Laundering compliance plays a vital role in protecting the financial system of the United Arab Emirates. The UAE follows strict laws to prevent money laundering and terrorist financing activities. These laws help maintain trust, safety, and transparency in business operations. Every obliged entity must follow these rules […]

Excise Tax Guide UAE by MAK Auditing 🥇

Excise Tax Guide in the United Arab Emirates Excise tax is an indirect tax that applies to specific products in the United Arab Emirates. The government introduced this tax to reduce the use of goods that can harm human health or damage the environment. This tax also helps the government raise funds for public services. […]