Professional License

The UAE has long been known for its dynamic economy and thriving business environment, making it a hub for professional in various fields. One of the most sought-after license for finance and accounting professionals is the Chartered Accountant (CA) professional license. This license allows professionals to work in accounting, auditing, taxation, and other related financial services, offering an excellent opportunity for those looking to establish or advance their careers in the UAE.

Local Companies Auditor Certificate MOE

In the UAE, a local company auditor plays a vital role in ensuring that businesses comply with financial regulations and maintain transparency in their financial reporting. The federal laws of the country mandate the role of an auditor in the UAE, all businesses, including local companies, must have their financial statements audited annually by a licensed auditor.

A local company auditor in the UAE conducts independent reviews of a company’s financial statements to verify their accuracy and ensure compliance with the country’s accounting standards. These audits help detect discrepancies, fraud, or mismanagement funds.

When selecting an auditor in the UAE, companies should ensure that the UAE’s Economic Department or the relevant authority in the free zone licenses the auditor. The auditor should also be familiar with the industry in which the company operates and have a strong reputation for reliability and professionalism.

In conclusion, a local company auditor in the UAE ensured financial transparency and regulatory compliance, helping businesses operate effectively in the competitive UAE market. This role is crucial in fostering trust with investors and authorities while enhancing the company’s financial integrity

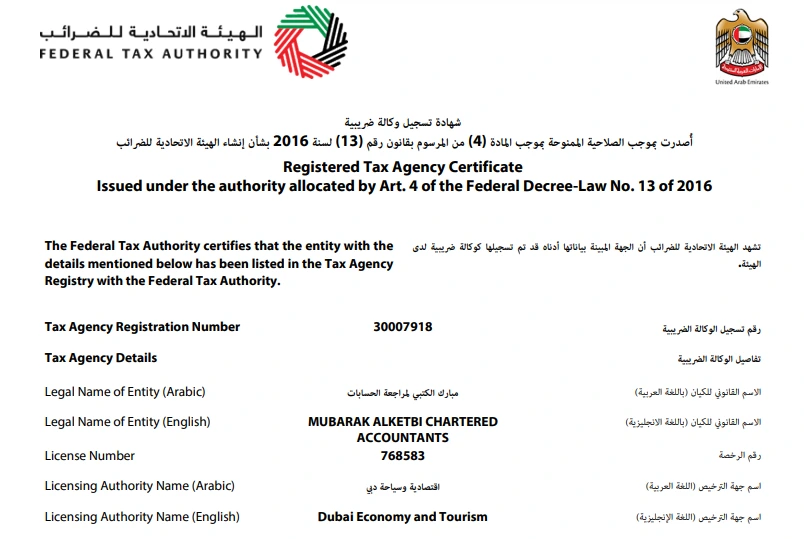

Tax Agency MAK Certificate

The FTA issues a Tax Agency Certificate to businesses that have registered with a qualified tax agent or tax consultancy firm. This certificate serves as an official acknowledgment that the appointed tax agent is authorized to represent the business in tax-related matters and dealings with the FTA. It is crucial for businesses that wish to delegate tax compliance, filing, and advisory services to a professional tax representative.

While appointing a tax agent is not mandatory for all businesses, it is highly recommended for those dealing with complex tax issues, especially VAT and excise tax. Businesses may appoint tax agent if they:

- Are not well-versed in tax laws and regulations

- Need assistance in filing VAT returns or excise tax returns.

- Require professional advice on tax planning, compliance, and dispute resolution

- Prefer a third party to handle all communications with the FTA.

The Tax Agency Certificate under FTA is an important document for businesses in the UAE that need professional assistance with tax compliance. By appointing a certified tax agent, companies ensure they are adhering to the country’s tax laws and benefit from expert guidance in navigating the complexities of VAT and excise taxes. This certificate helps establishing a reliable and professional relationship between businesses and the FTA, ensuring smooth tas management and compliance.